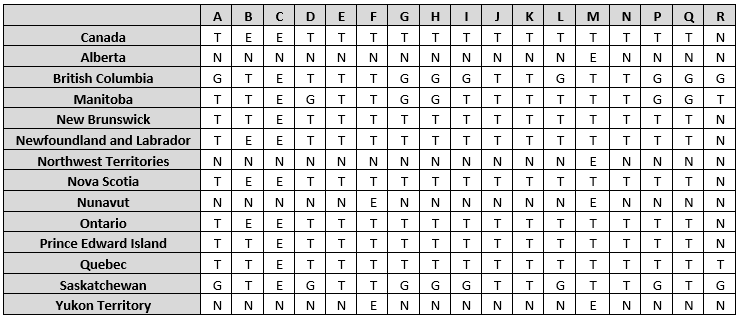

avalara tax codes canada

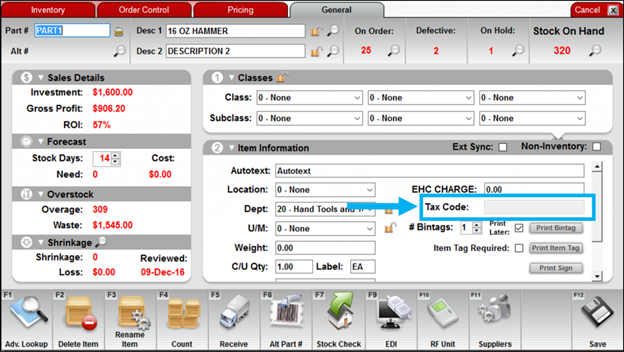

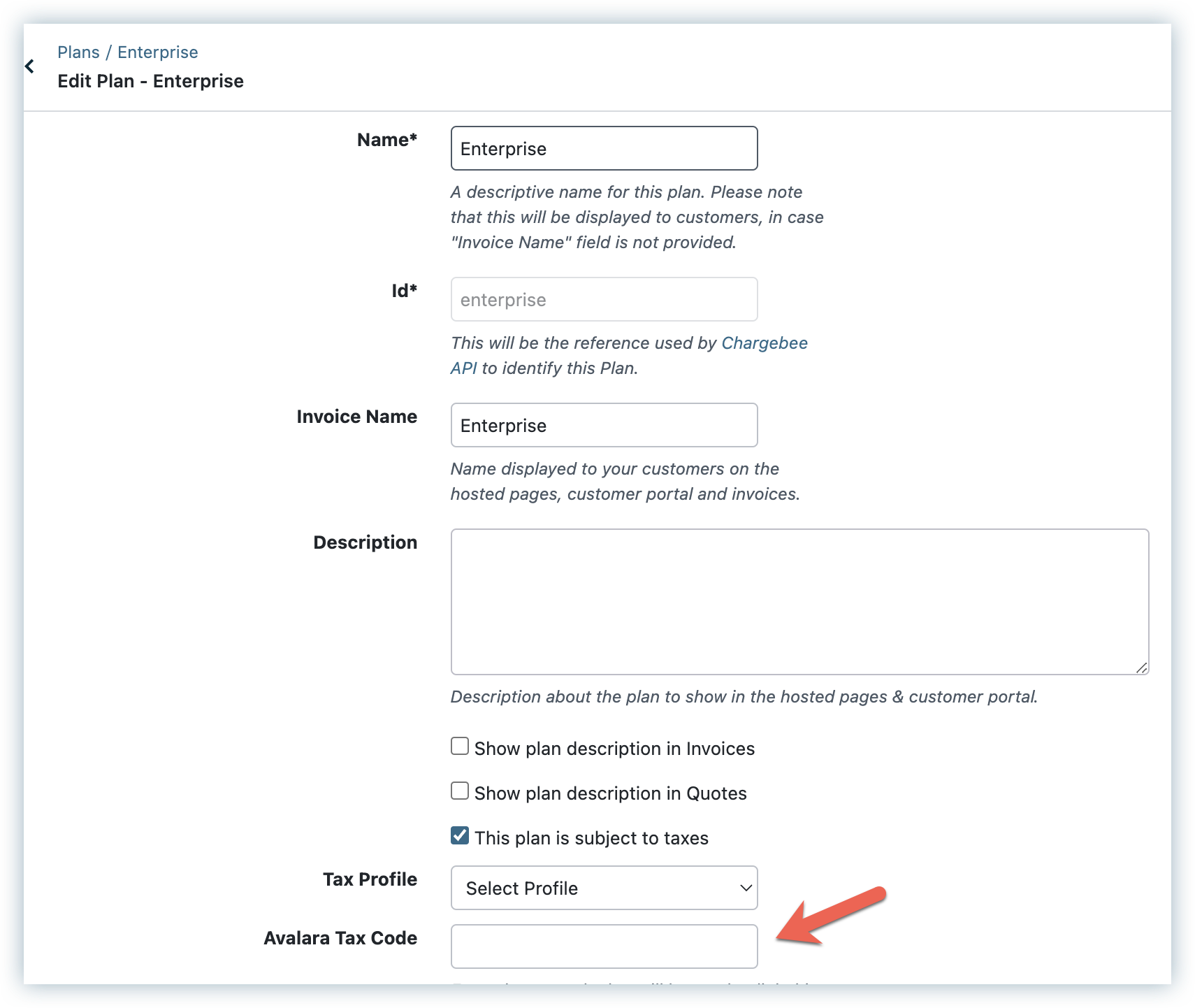

If youre already using Avalara tax. TaxCode the Avalara Product Tax code for the variant.

You can copy and paste from an Excel.

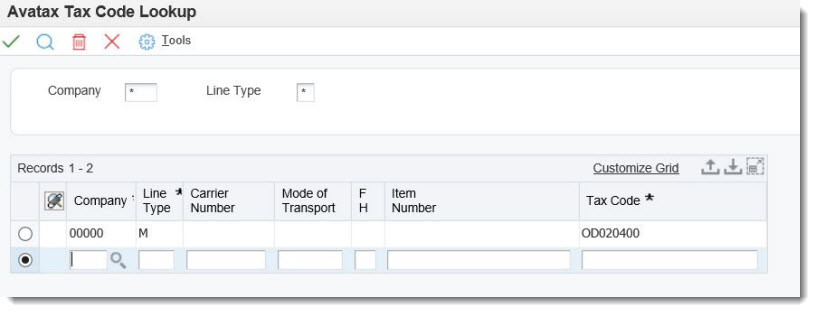

. 159 rows Supported regions. Create an Exempt Entity Tax Rule making the entity use code of your. You can either start typing and select from the list of available tax codes or paste the appropriate tax code.

The frequency depends on the annual turnover of the business. If you must map more than 100000 SKU codes to. AvaTax for Communications supports tax calculation for a number of countries states territories and provinces.

Add up to 20 tax codes. Businesses GST registered in Canada must submit periodic GST returns. Were sorry but Tax Codes Search doesnt work properly without JavaScript enabled.

Federal GST is levied by the Canadian Revenue Agency and the tax code is contained within the Excise Acts. Returns preparation filing and remittance. Sales and use tax determination and exemption certificate management.

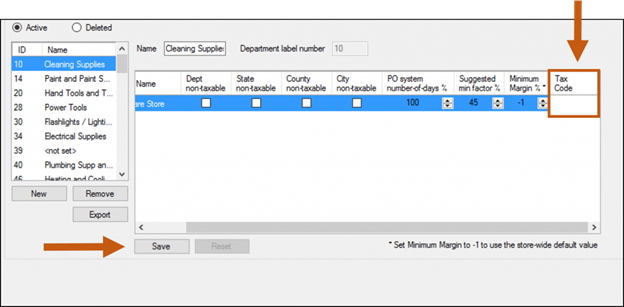

Create the import file using the item and tax code import template guidelines. Marketplace facilitator tax laws. 15 rows Avalara Partners Program.

Find the Avalara Tax Codes also called a goods and services type for what you sell. Create a Product Taxability Tax Rule making the tax codes of the products non-taxable in Canada and in the province. Find the Avalara Tax Codes also called a goods and services type for what you sell.

Select Import items. International freight transportation services that involve transportation of goods from a place. There are a couple of different ways to learn which rate to use for what you sell.

Find the Avalara Tax Codes also called a goods and services type for what you sell. GST was introduced into Canada in 1991. You can use this search page to find the Avalara codes that determine the taxability of the goods and.

Please enable it to continue. You can copy and paste a code you find here into the Tax Codes field in the Items or What you sell. Set up tax rules to calculate GST for your tax codes.

Canada to tax non-resident sales of digital products and more North America Feb 25 2021 How to ensure the right sales tax rate is applied to each transaction. So far in the developer guide your code has left the taxCode field emptyIn this case AvaTax assumes you are creating transactions that refer to general Tangible Personal Property which. To ensure accurate tax.

Find the Avalara Tax Codes also called a goods and services type for what you sell. Its important to note that there is a maximum of 100000 items per import. Avalara Self-Serve Tariff Code Classification is an intuitive AI-enabled tool that allows you to easily determine codes and requires no prior experience in HS classification.

Download the Item Import toolkit and the Avalara tax code list. Freight transportation services that involve transportation of goods from a place outside Canada to a.

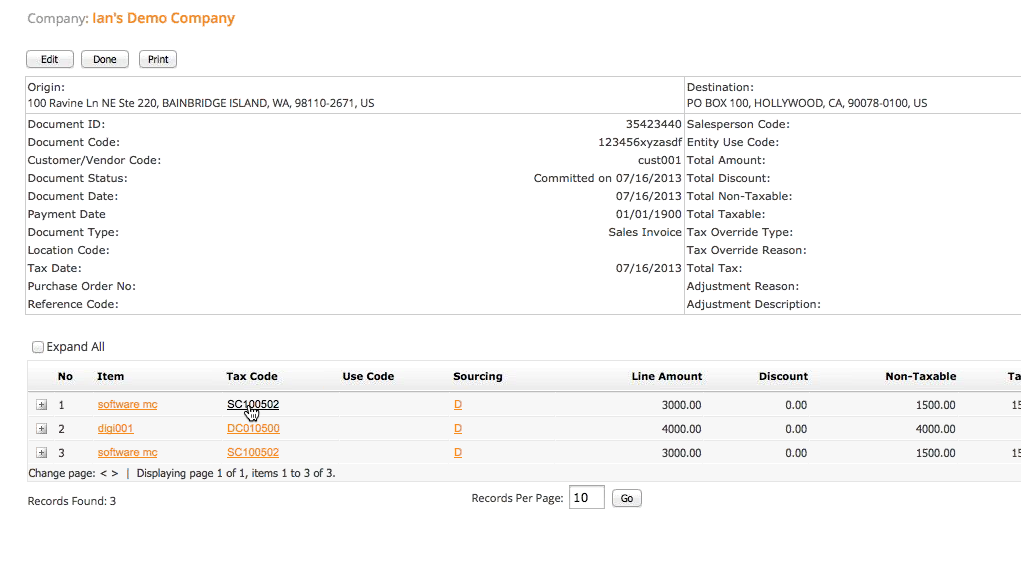

Avalara Avatax Sales Tax Automation Product Evaluation Business 2 Community

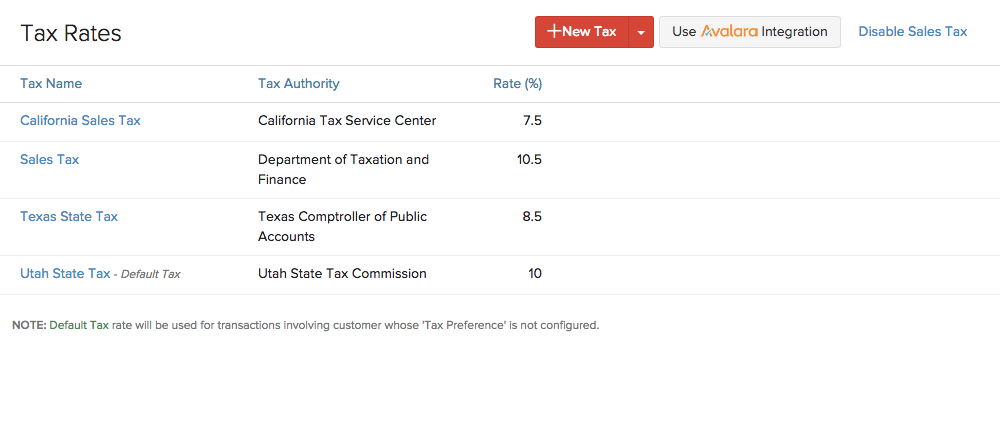

Tax Compliance Software And Automated Solutions Avalara

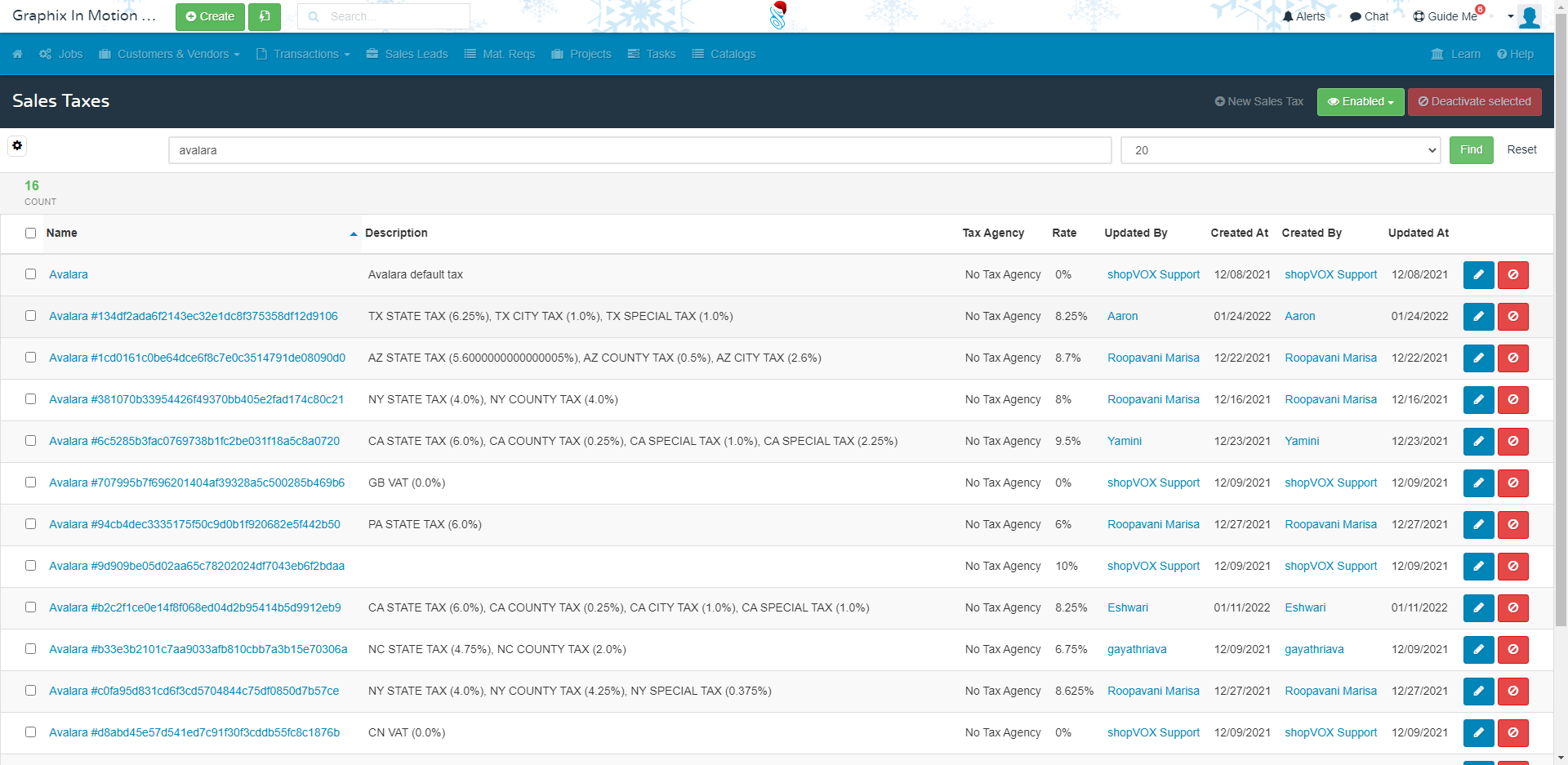

Wbavatax Avalara Avatax Tax Calcuation Integration Whmcs Marketplace

Scalefactor Partners With Avalara Tax Compliance Software Scalefactor

Map Item To Avalara Tax Code Avatax Youtube

Avalara Avatax Integration Help Zoho Books

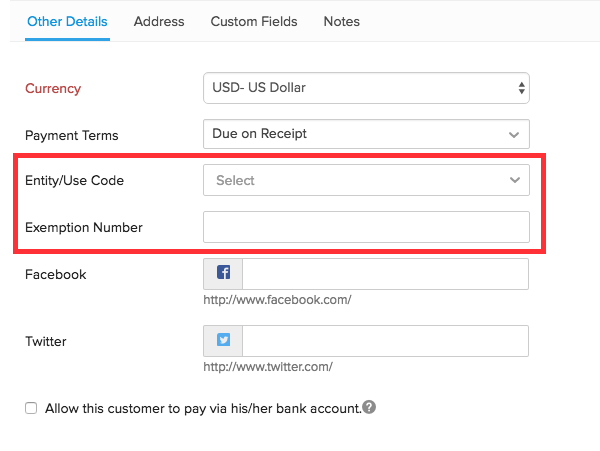

Avalara Avatax Set A Customer To Be Tax Exempt In U S And Canada

Avalara Avatax Sales Tax Setup Guide Shopvox Help Center

Avalara Avatax Integration Help Doc Zoho Subscriptions

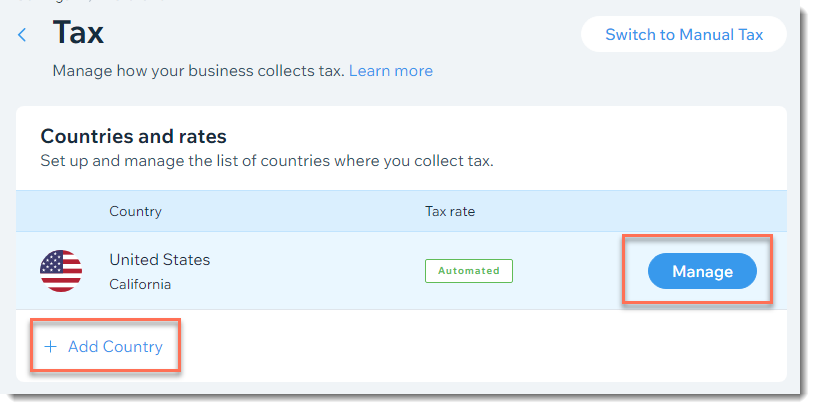

Wix Stores Setting Up Automatic Tax Calculation With Avalara Help Center Wix Com